- #TAX RETURN STATUS FULL#

- #TAX RETURN STATUS PRO#

- #TAX RETURN STATUS VERIFICATION#

- #TAX RETURN STATUS PROFESSIONAL#

Gather the following information and have it handy:.Currently you might be waiting a bit longer to receive a refund due to the effects of COVID-19, new tax law changes, and possible errors made on the tax return.įollow these steps for tracking your 2021 federal income tax refund: You can start checking on the status of your refund within 24 hours after the IRS has received your electronically filed return, or 4 weeks after you mailed a paper return.

Register as an approved IRS business partner and conduct business electronically with the IRS.If you filed a 2021 federal income tax return and are expecting a refund from the IRS, you may want to find out the status of the refund or at least get an idea of when you might receive it. It's mandatory for anyone who prepares or assists in preparing federal income tax returns for compensation. Preparer Tax Identification Number (PTIN)

#TAX RETURN STATUS PRO#

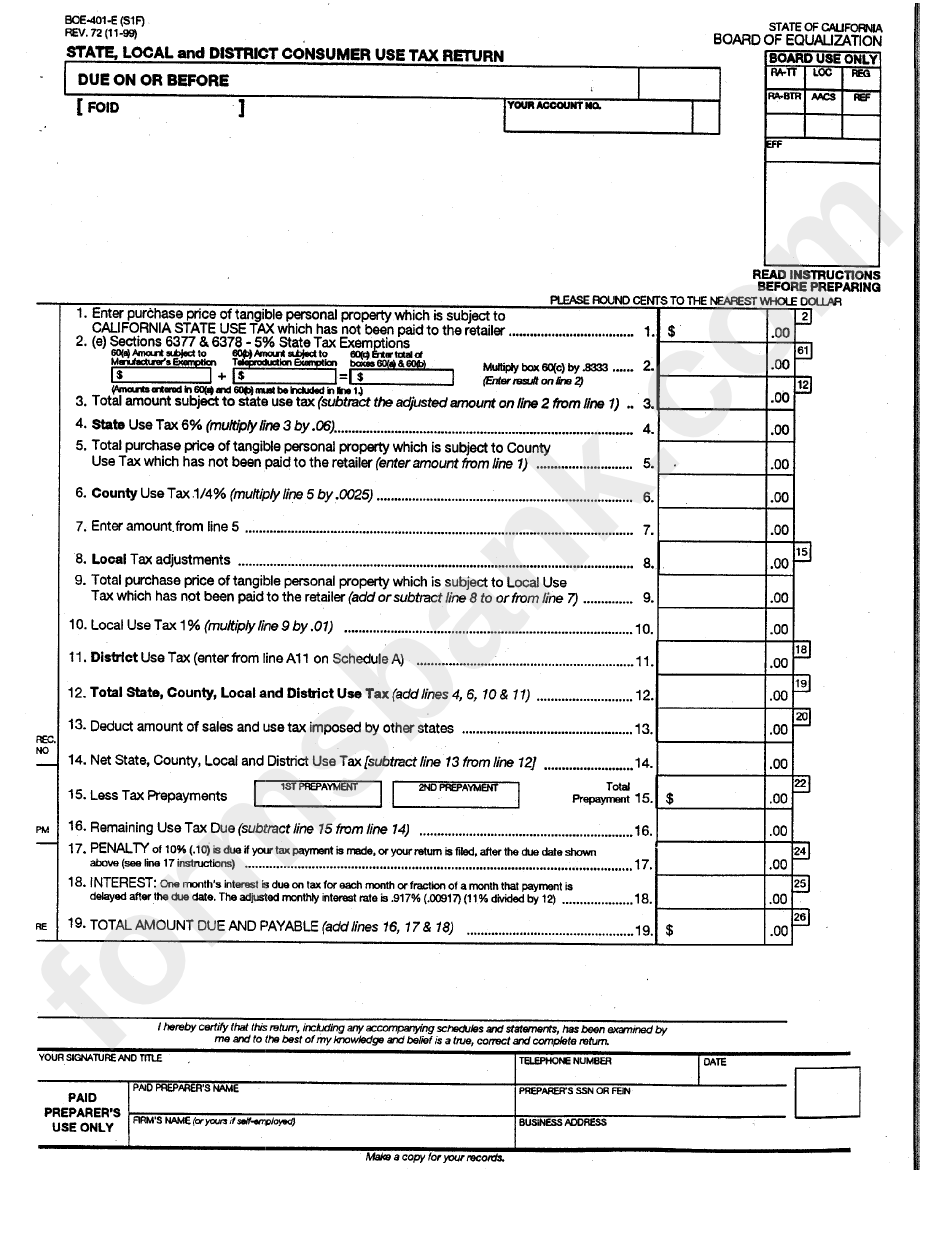

Tax Pro Account lets you submit an authorization request to an individual taxpayer’s IRS online account. Pay your federal taxes online or by phone with EFTPS, a free tax payment system. Use the search and download tool to find out if a Foreign Financial Institution has registered with FATCA.Įlectronic Federal Tax Payment System (EFTPS) Track important business tax dates and deadlines right from your desktop.įATCA Foreign Financial Institution (FFI) List Search and Download Tool Get your EIN online without calling us, or mailing or faxing a paper Form SS-4, Application for Employer Identification Number (EIN). Taxpayer Assistanceįind a Taxpayer Assistance Center if your tax issue can’t be handled online or by phone. CalculatorsĮstimate the amount of federal income tax your employer should withhold from your paycheck.ĭetermine the amount of optional state and local general sales tax you can claim when you itemize deductions. Search for a charity or non-profit organization and find out if it’s eligible to receive tax-deductible contributions.įirst Time Homebuyer Credit (FTHBC) Account Look-upĬheck your First Time Homebuyer Credit account balance and payment history online. Credits and DeductionsĮarned Income Tax Credit (EITC) Assistantįind out if you’re eligible and estimate the amount of your Earned Income Tax Credit.

#TAX RETURN STATUS FULL#

Make a guest payment (without registration) directly from your checking or savings account.įind out if you’re eligible to make payment arrangements on the amount of tax you owe if you can’t afford to pay all of it at one time.įind out if you’re eligible to apply for an Offer in Compromise, a settlement for less than the full amount of tax you owe. Refunds and PaymentsĬheck the status of your income tax refund for recent tax years.Ĭheck your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more.Īccess your individual account information to view your balance, make and view payments, and view or create payment plans.

#TAX RETURN STATUS PROFESSIONAL#

Search for preparers in your area who hold professional credentials recognized by the IRS. Get free tax help for the elderly, the disabled, people who speak limited English and taxpayers who qualify according to their income level.ĭirectory of Federal Tax Return Preparers Locate an authorized e-file provider in your area who can electronically file your tax return. Prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an IRS partner site or using Free File Fillable Forms.

#TAX RETURN STATUS VERIFICATION#

Order copies of tax records including transcripts of past tax returns, tax account information, wage and income statements, and verification of non-filing letters. For Individual Taxpayers AccountĪccess your individual account information to view your balance, make and view payments, view or create payment plans, manage communication preferences, access some tax records, and view and approve authorization requests. Use the Interactive Tax Assistant to find answers to your tax law questions.īrowse the tax tools available for individual taxpayers, businesses, and tax professionals.

0 kommentar(er)

0 kommentar(er)